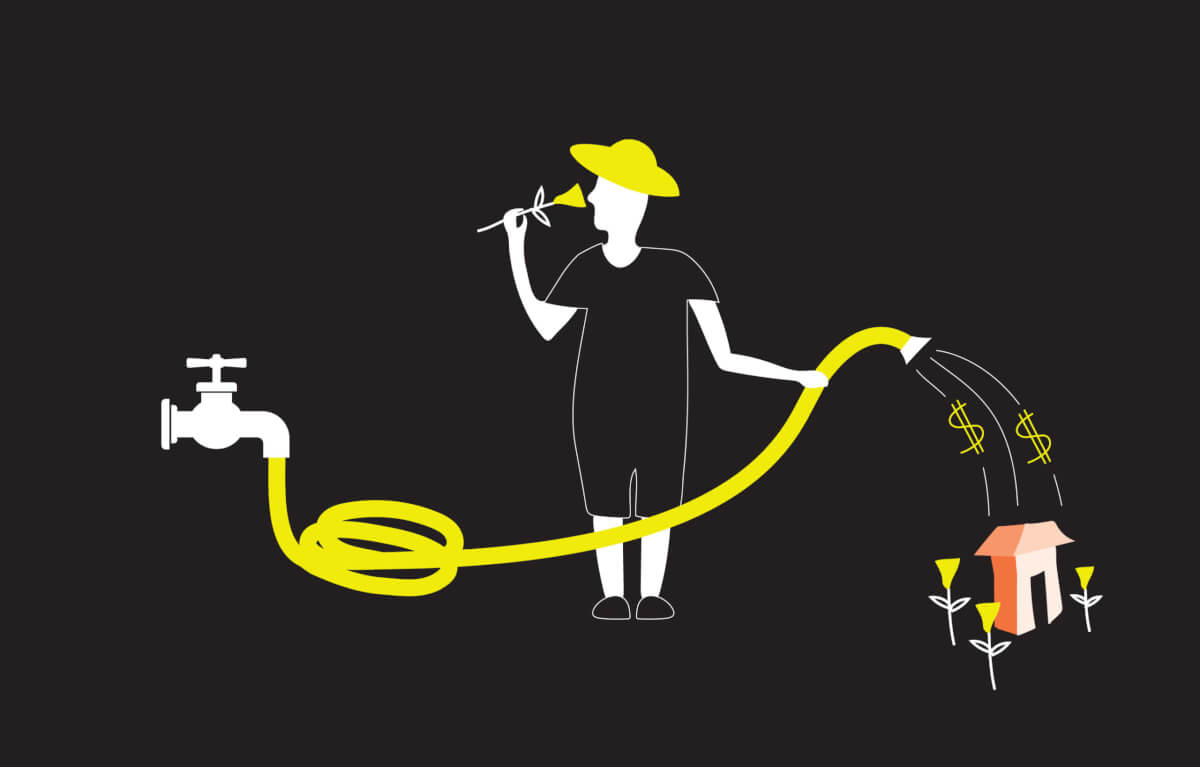

We’ve shared how to analyze your business’ cash flow. Since this is such an important topic for business owners, we are continuing our discussion this week with some tips on how to manage and maintain healthy cash flow in your business.

Get Disciplined with Invoicing

Slow invoicing is one of the biggest reasons why businesses fall short on cash. Many business owners don’t treat invoicing as a priority compared to day-to-day activities of delivering their product or service. But, if you don’t invoice, you won’t get paid by your customers. Create discipline around your invoicing practices by setting aside 15-30 minutes on the same day and time each week to review and process your invoices and payments. Be sure to address invoices that need to be created and sent to customers, invoices that have been paid, invoices that are outstanding and when payments are expected, and also be sure to review customers who are past due on their invoices and need to be reminded to pay.

Review Your Expenses

Every business is different and has its own specific expenses at various stages of development. Take a look at all the expenses your business has on an ongoing basis. Evaluate which expenses are necessary for running your business right now, which expenses are related to investment in business development opportunities and which expenses are simply “nice to have.” To improve cash flow in your business, you want to minimize the spending outside of the necessary expenses and make sure you are investing in business development activities that are yielding or expected to yield a reasonable return.

Pay Your Bills on Time

When cash flow seems thin, it’s common for business owners to start paying their bills late. But, by paying late, you’re just moving your cash problem to a future period. In addition, you may be hurting your business’ reputation with vendors. Just like your business, your vendors rely on timely payments from their customers to maintain healthy cash flow and do their work. As such, it’s important to pay your bills on time. But if it’s really not possible to pay your bill on time, communicate with your vendor about your cash flow situation, how you are working to improve cash flow, and when you expect to pay them. If you maintain good relationships with your vendors by paying on time, they are more likely to help you out when cash flow is light.

Try Bartering

If you have excess available inventory or capacity to deliver your service, consider bartering to improve cash flow. Bartering allows you to accept payment from customers in trade dollars instead of cash, and then use those trade dollars to purchase goods or services needed to run or invest in your business, also without using cash. You can enter into a barter arrangement directly with another business or person, or through a time bank (a work-trade system in which hours are the currency) or a barter exchange (a third party that coordinates barter transactions).

Have a Financing Option

Despite your best efforts to track and manage your cash flow, unexpected events will occur that can throw off your cash flow. These could be positive for your business, such as a customer asking you to fulfill a big order, or negative for your business, such as a commercial landlord raising your rent. When these events occur, you might need to rely on another source of cash for your business, such as personal savings, credit cards, friends and family, or a business loan. It’s typically more difficult to get financing when the event is occurring – many financial institutions hesitate to provide financing to business owners in time of distress and those that do often charge usurious rates and/or you may not be able to carve out the time to evaluate and enter into a reasonable financing arrangement. Having a backup financing option in place will provide a cushion for unexpected events.

Taking proactive steps in managing your business’ cash flow will help you improve operations, free up cash for investment in business development, and reduce your stress as a business owner.